City councillors have been told that Lancaster City Council was approached at short notice about establishing a Heysham Investment Zone.

Governments’ backed Investment Zones

Governments’ backed investment zones were launched in September. They will be a low-tax, low-regulation zones that will be created in every part of England as quickly as possible in order to encourage rapid development and business investment.

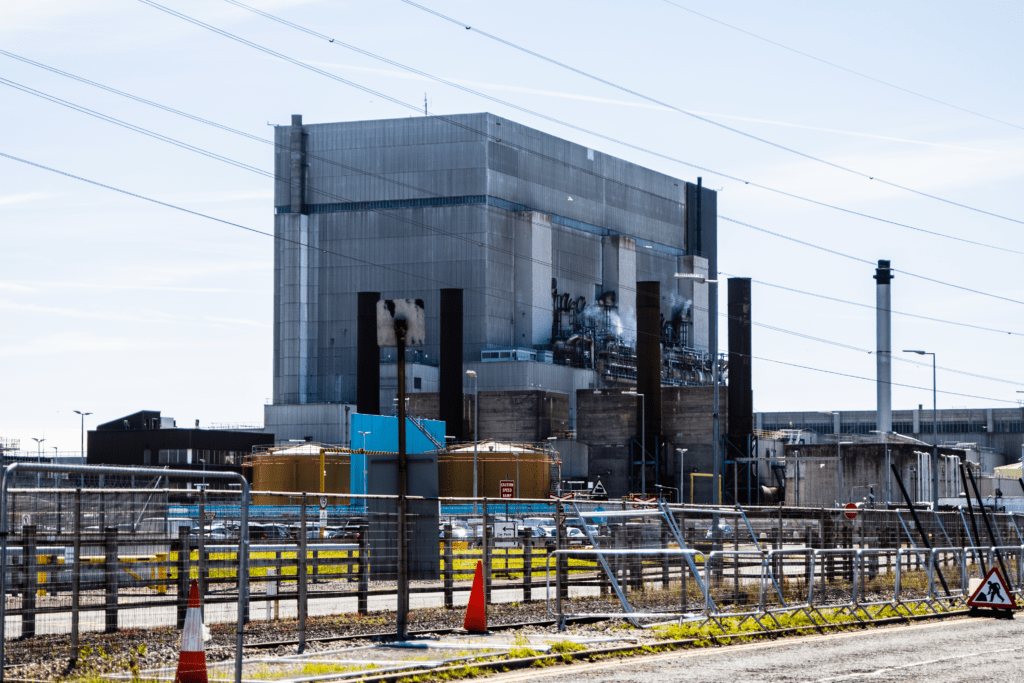

Heysham site could be one of the places established as the investment zone. This would bring a great incentive for investment in the area. This could include a total relief from business rates and stamp duty as well as National Insurance relief for the employers who taken on new workers and enhanced tax allowances in order to increase investment.

Planned investment zone tax reliefs and incentives include:

Enhanced Capital Allowances

100% first year allowance for companies’ qualifying expenditure on plant and machinery assets for use in tax sites

Enhanced Structures and Buildings Allowance

Accelerated relief to allow businesses to reduce their taxable profits by 20% of the cost of qualifying non-residential investment per year, relieving 100% of their cost of investment over five years

Stamp Duty Land Tax (SDLT) Relief

Full SDLT relief for land and buildings bought for use or development for commercial purposes, and for purchases of land or buildings for residential developers

National Insurance relief

Zero-rate Employer NICs on salaries of any new employee working in the tax site for at least 60% of their time, on earnings up to £50,270 per year, with Employer NICs being charged at the usual rate above this level

Business Rates Relief

100% relief from business rates on newly occupied business premises, and certain existing businesses where they expand in English Investment Zone tax sites. Councils hosting Investment Zones will receive 100% of the business rates growth in designated sites above an agreed baseline for 25 years.

In designated development sites, more land will be released for housing and commercial development. The need for planning applications will be minimised and applications streamlined. Development sites may be co-located with, or separate to, tax sites, depending on what makes most sense for the local economy.

Recent Comments